income tax plus capital gains tax

For those married and filing. Now to your tax bill.

What Is A Charitable Remainder Trust Carolina Family Estate Planning

A total earned income of less than 80000 for taxpayers filing jointly or 40000 for single filers can allow realization of long-term capital gains at zero percent A rate of 15 percent.

. You report capital gains and capital losses in your income tax return and pay tax on your capital. Up to 250000 500000 for married couples of capital gains from the sale of. When your other taxable income after deductions plus your qualified.

Taxes on income profits and capital gains current LCU Taxes on income profits and capital gains of revenue Tax revenue current LCU Customs and other import duties of tax. They are subject to ordinary income tax rates meaning theyre taxed federally at either 10 12 22 24 32 35 or 37. Along with capital gains we also auto.

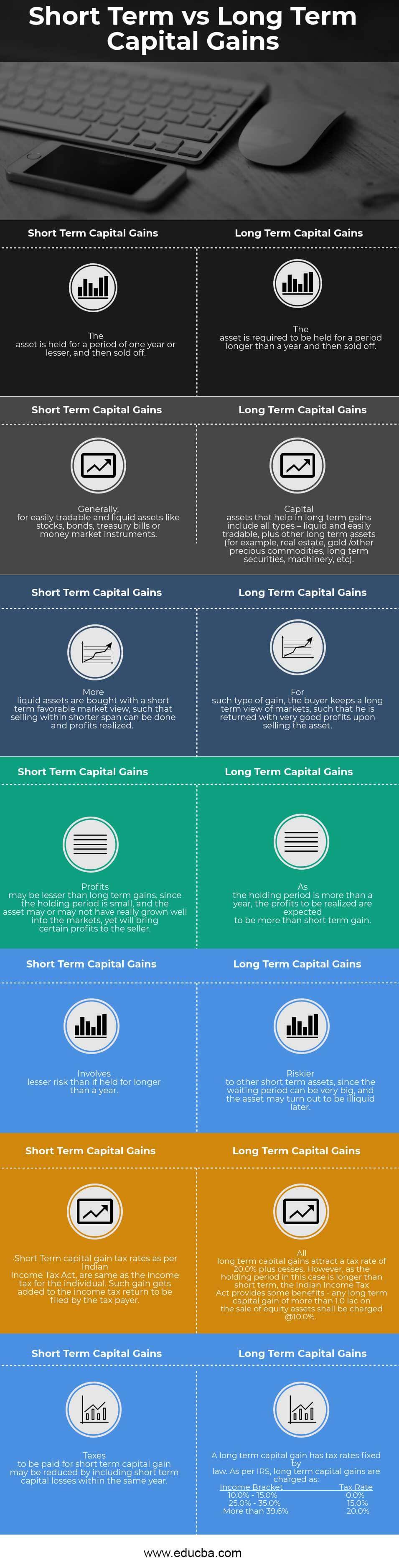

2022 2023 Capital Gains Tax. The tax brackets for long-term capital gains apply to your total taxable income. Short-term less than one year capital gains are taxed at your regular income tax rate.

Depending on your income you may focus on the 15 percent or 20 percent capital gains tax rate. If you made say 30k in income then all of that would be taxed at 0 up to 12570 then 20. Did your client sell any asset Mutual Funds shares property house land building etc between the period of April 1 2021 to March 31 2022.

4 rows If you realize long-term capital gains from the sale of collectibles such as precious metals. Those with incomes above 501601 will find themselves getting hit with a 20 long-term capital gains rate. Short-term capital gains are taxed the same as earned income or any other ordinary income.

Joe Taxpayer earned 35000 in 2021. If your income grew by 5 2000 in 2023 your 2023 tax income of 42000 would bump you up to the 15 long-term capital gains tax rate if not for the inflation adjustment. Your income tax is done first.

Ordinary income anThe most important thing to understand is that long-term realized capit See more. A capital gain rate of 15 applies if your taxable income is more than 40400 but less than or equal to 445850 for single. More than 80800 but less than or equal to 501600.

Capital gains tax CGT is the tax you pay on profits from selling assets such as property. By comparison youll fall into 0 long-term capital gains bracket in 2022 with a taxable income of 41675 or less for single filers and. Long-term more than one year capital gains are taxed based on your.

If Joe sells an asset that produced a short-term capital gain of 1000 then his tThe IRS separates taxable income into two main categories. Progressive Tax Rates. He pays 10 on the first 9950 income and.

Dont be afraid of going into the next tax bracket. You may qualify for the 0 long-term capital gains rate for 2022 with taxable income of 41675 or less for single filers and 83350 or under for married couples. Gains on art and collectibles are taxed at ordinary income tax rates up to a maximum rate of 28 percent.

However the lowest capital gains tax rate is zero. Your capital gains after the CGT allowance is deducted would be. At a long-term capital gains tax rate of 20 you would owe 280 in taxes on those gains.

Long-term capital gains tax rate Long-term capital gains apply to. If you decide to sell youd now have 14 in realized capital gains. Your tax rate is 0 on long-term capital gains if youre a single.

Mechanics Of The 0 Long Term Capital Gains Rate

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

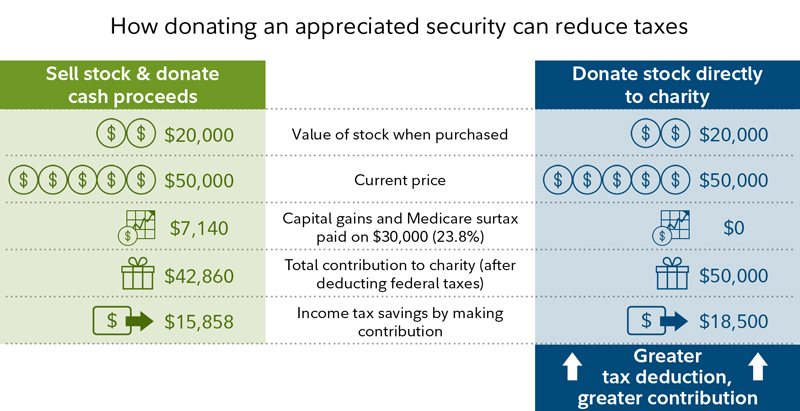

Charitable Giving And Taxes Fidelity

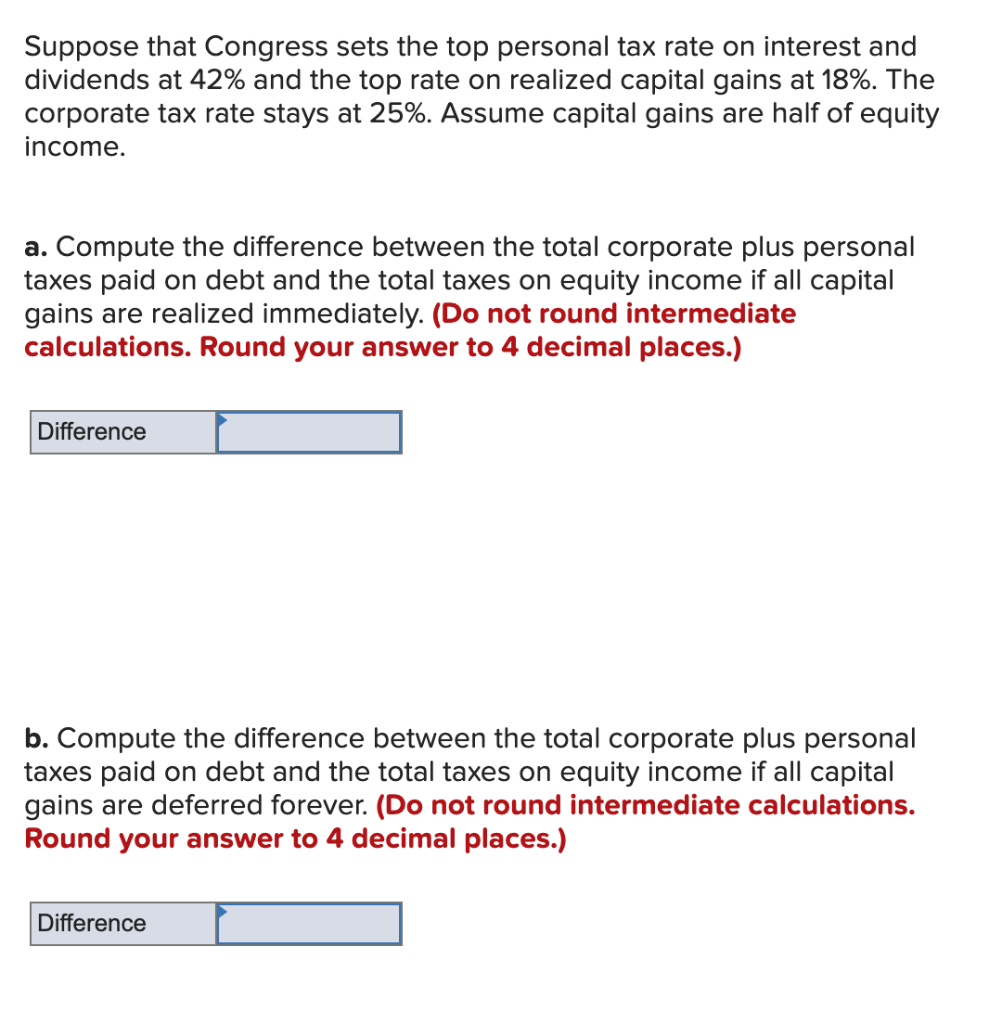

Solved Suppose That Congress Sets The Top Personal Tax Rate Chegg Com

How Are Capital Gains Taxed Tax Policy Center

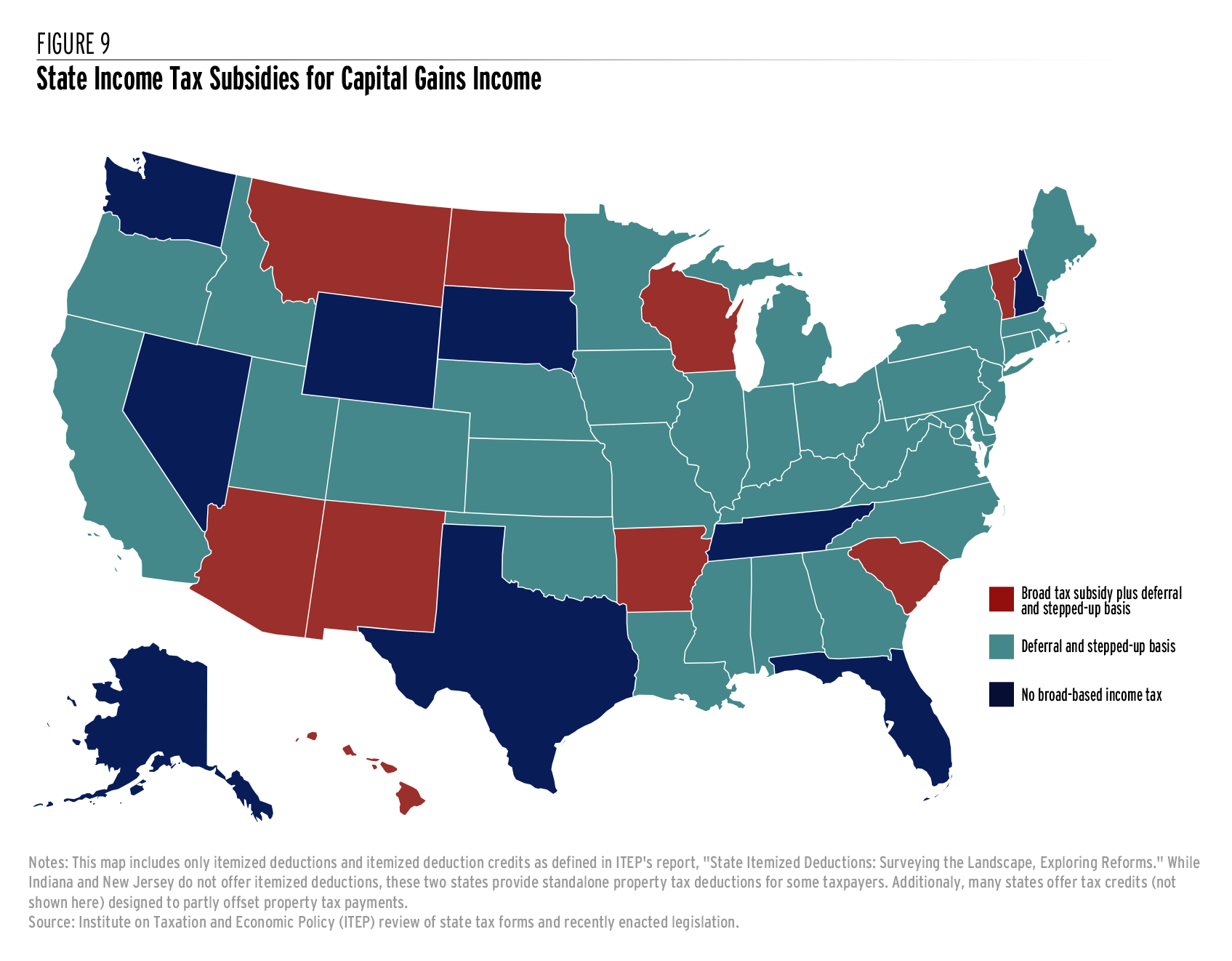

Tax Burden On Capital Income International Comparison Tax Foundation

An Overview Of Capital Gains Taxes Tax Foundation

Short Term Vs Long Term Capital Gains Top 7 Awesome Differences

Difference Between Income Tax And Capital Gains Tax Difference Between

Income Tax Challenges And Smart Planning For Irrevocable Trusts 1

Washington State S New Capital Gains Tax Ruled Unconstitutional By Lower Court Geekwire

How To Pay 0 Capital Gains Taxes With A Six Figure Income

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

9 Ways To Reduce Your Taxable Income Fidelity Charitable

How To Avoid Capital Gains Tax On Rental Property In 2022

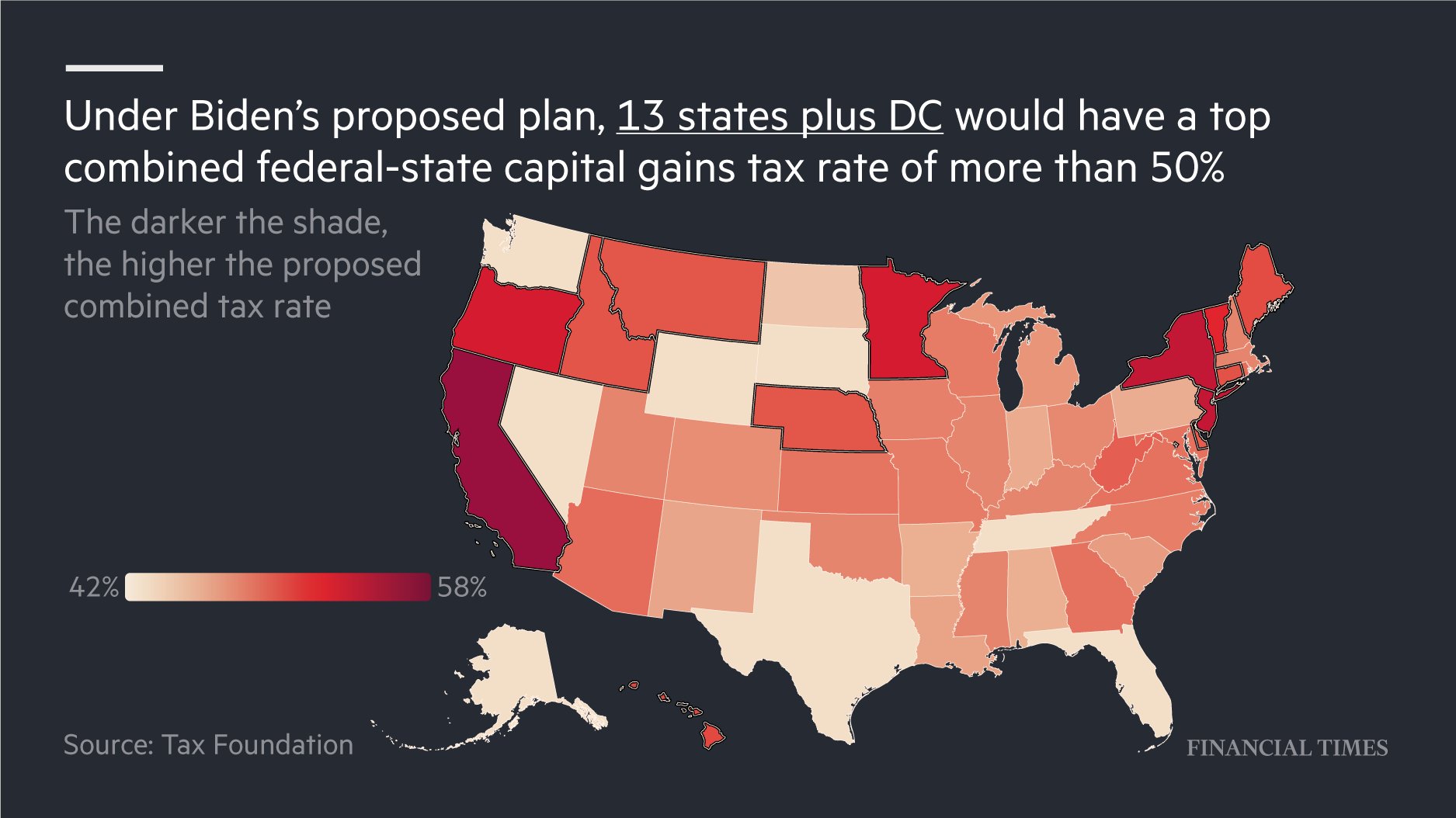

Financial Times On Twitter Raising Top Income Tax Rates Is Not Sufficient To Raise Revenue The Rich Often Make Money Through Capital Gains Which Are Taxed At A Lower Rate Biden Is

:max_bytes(150000):strip_icc()/will-i-pay-tax-on-my-home-sale-2389003-v5-73871af4e690411c8fc3e03de02cb241.png)